Obamacare’s choices:

You are 25 years old, healthy, single, self employed, and have annual income of $35,000. Consider this 2014 choice.

- You can buy Obamacare health insurance for 2014 for $2,545 that has an annual out of pocket maximum of $6,350. So, if you have need for serious medical care you will have maximum costs of $8,895.

- Because you did not buy Obamacare health insurance you might need to pay a tax of $350, plus you will need to pay for all your health costs realized in 2014. You know that you will be able to buy a health policy at close to the same 2014 price effective January 1, 2015.

Hmmmm…. if I don’t have any health problems of note in 2014 I can (1) pay a premium of $2,545 plus some minor out of pocket costs or (2) pay the same minor out of pocket costs plus (maybe) a $350 tax. Am I willing to take the chance that if I do get sick I will have to spend more than the premium and out of pocket maximum less the tax (about $8,500)?

Which would you chose and why?

The academic behavioral geniuses who designed the Rube-Goldberg contraption we know as Obamacare think millions of young people will buy the insurance. I doubt it.

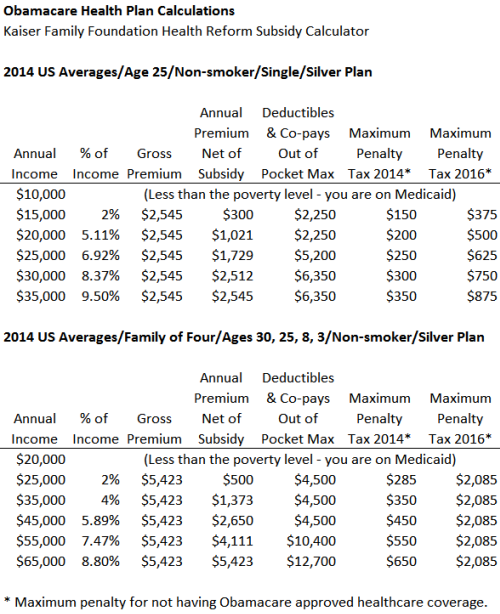

Here is a table I created using the Kaiser Health Obamacare calculator.

It seems reasonable that even those getting a subsidy might consider themselves better off paying the penalty tax and not buying a policy.

Interesting perhaps but it means nothing to Mr. Obama as his goal is to make insurance available to those who do not have it (most by their own choice) at any cost. He could care less if someone who does not qualify for a subsidy buys insurance. Obamacare is set up so the government pays for insurance company loses for the next three years if they don’t sign up enough healthy people with policies having excessive coverages that are therefore over priced.

Subsidy costs and insurance company loses will be picked up by all US taxpayers regardless of how many young healthy people buy Obamacare policies.

Regards, Pete Weldon

americanstance.org