UPDATE March 11, 2013 – Read Bjorn Lomborg’s take on these issues.

I am all for the private sector investing in new car technology. The realities of taxpayer funding of electric cars, however, demonstrate ignorant and incompetent leadership.

It is one thing to have a realistic vision of the future and another to simply waste billions of our money on pipe dreams. The circumstances surrounding subsidies for the Chevy Volt clearly fall in the later category. The subsidies are a waste, not an investment, by any stretch of language or imagination.

I am all for effective alternatives to burning fossil fuel. We all know that stuff will eventually be in limited supply because we are consuming it all, worldwide, over time. Add in the environmental concerns about the by-products of burning fossil fuels and you can gin up quite the emotional story line.

If only we could replace that fossil fuel consumption with something more, shall we say, “attractive.”

Problem is, studies on the full life cycle environmental impact of electric cars from raw materials, to fabrication, to assembly, to usage, to reclamation show marginal, if any, benefit versus purely gasoline powered cars. Just do a search for “environmental impact of electric cars versus gas powered cars” and read a few articles to understand for yourself.

So, it would be nice to have a marginal benefit presuming there was one to talk about. But at what cost?

Here is a specification comparison of the 2012 Chevy Volt with the 2013 Chevy Cruze. Note that the Volt is built on the same basic platform as the Cruze. They have the same wheelbase and four doors. However the Volt sells for $39,995 USD before tax credits and the Cruze comparably equipped with leather seating, etc., etc. lists for $24,345 USD. (The Volt is estimated to cost as much as $89,000 per car to produce.) The Volt seats 4 people while the Cruze seats 5. The Volt weighs 3,781 lbs while the Cruze weighs 3,155 lbs. The Volt has almost 5% less passenger space and 40+% less truck volume than the Cruze.

So what is better about the Volt? Volt mileage is rated at 40 MPG highway and 35 city. Cruze mileage is rated at 38 MPG highway and 26 city. The 2013 Volt is supposed to get a total of 380 miles on a full charge and full tank, 38 electric miles and 342 miles burning fossil fuel to generate electricity. That’s 36.8 MPG on a 9.3 gallon gas tank going 342 miles plus an imputed 45.8 MPG for the rated 38 all electric miles (based on 37.5 MPG at half highway half city use per full charge/full tank).

A Chevy Cruze driving cycle of half highway and half city driving rates out at 32 MPG versus 37.5 for the Volt. That savings converts to 55 gallons of gas saved per year for the Volt based on driving 12,000 miles per year. At $3.50 per gallon the Volt driver is saving a little less than $200 per year. Based on the list price differential of $15,650 it would take over 78 years to pay back the increased cost of the Volt. Assuming you can take the full $7,500 tax credit offered by the government (and it will not fully apply in all circumstances) it would still take over 40 years to pay back the increased price of the Volt AND you get less car and assume more resale risk with the Volt. In the best possible scenario if you drove only 38 miles per day and used the Volt only on electricity the EPA says you would get the equivalent of 98 MPG versus a blended highway/city 32 MPH for the Cruze. At $3.50 per gallon the annual savings from the Volt if used in this way would be about $1,000 per year, resulting in a 7 to 15 year payback depending on how much of the tax credit you can realize. Now you need to ask how the person realizing any saving from using the Volt will be spending that money. Will they buy a JetSki or take an airplane trip on a nice fossil fuel burning vacation? Where, exactly, is the benefit and why are we paying to subsidize the reality that there is none?

Spending (actually borrowing) billions of dollars subsidizing the production and sale of electric vehicles such as the Chevy Volt makes no sense in any context other than political favoritism.

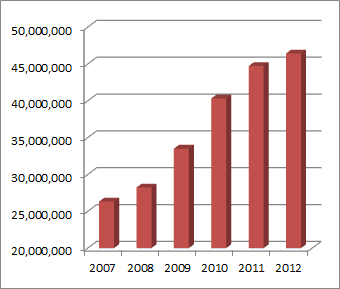

This Department of Energy piece is a good starting point for understanding the government myopia and hubris underlying the subsidies. It seems the Department of Energy believed GM would produce (and necessarily sell) 120,000 Volts in 2012. Actual 2012 Volt sales through August were 13,500 and those were driven by discounted leases.

This article is a good starting point for understanding the extent of government subsidies supporting the production and sale of the Chevy Volt. That’s right, $3,000,000,000 of our money to subsidize a product that is too expensive and insufficiently compelling to sell, even with a potential $7,500 tax credit that we pay for.

Here is a good article on the possible marginal environmental benefits of electric vehicles. Seems we would be in great shape only if all our electricity were generated by nuclear and hydro power. Electric vehicles actually increase environmental damage in areas where coal is the primary source of electricity. Makes me wonder how to infuse reality into government planning.

For the truly obsessed, here is a Wiki piece on electric vehicle subsidies by country.

And to top this all off, according to the Wall Street Journal, US taxpayers owned 26.9% of General Motors as of September 2012. GM stock would need to reach $53 a share for the U.S. to break even on the government ownership interest. GM stock is currently trading near $25 a share. That’s about a $12,000,000,000 loss we are paying for in addition to the $3,000,000,000 in Volt related subsidies.

What more do we need to stop the nonsense? When will those responsible admit to this failure and accept responsibility for it? How many more borrowed dollars need to be wasted for the taxpayers to wake up?

Regards, Pete Weldon

americanstance.org